Mandatory ISD Registration Under GST – Action Required Before 1st April 2025

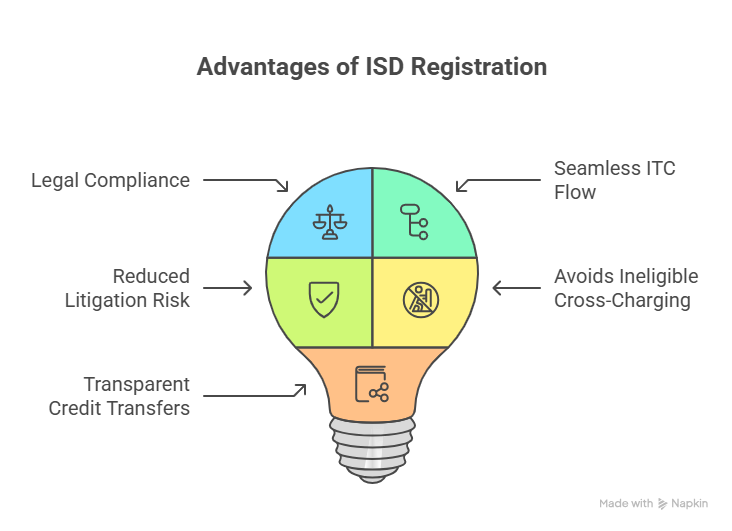

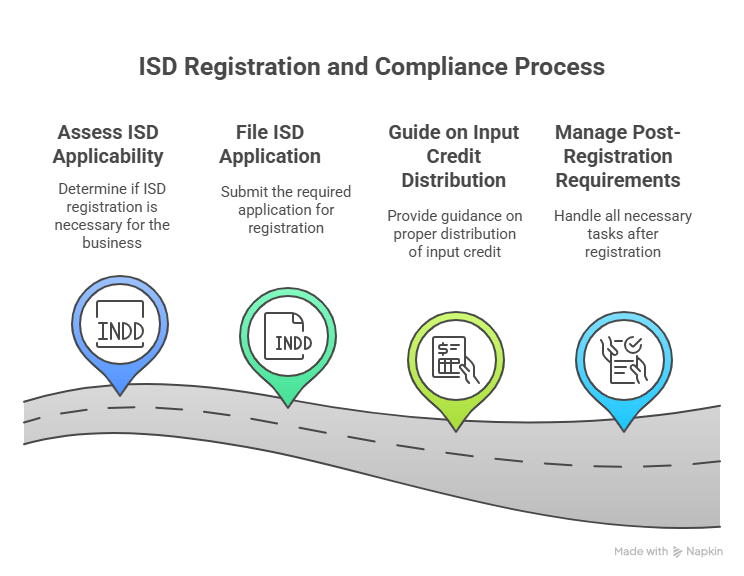

Starting 1st April 2025, as per the Finance Act, 2024, it is compulsory for businesses to register as an Input Service Distributor (ISD) under GST. This applies if your head office or any branch receives invoices for services used by multiple units located in different states – for example, common services like audit, software, or advertising. Even if you already have a regular GST registration, a separate ISD registration is now required to share the tax credit for such services with other branches. From this date onwards, using tax invoices (cross-charging) for credit distribution will no longer be allowed

⚠️ What Happens If Not Complied With:

Issue | Impact |

| Legal Non-Compliance | Violation of GST law (Sections 24 & 20) |

| ITC Loss | You may lose eligible tax credit |

| Penalty & Interest | Penalty of ₹10,000 or tax amount involved + interest |

| Operational Issues | Cross-charging no longer permitted |

| Audit Risk | Higher chances of notices and credit rejection |

We recommend starting the ISD registration process as soon as possible to stay compliant and avoid disruptions.

Please feel free to contact us for any questions or support.

Contact details- 9107016666, 9579656446

Email ID - office.vedantainformatics@gmail.com